Why You Need health Insurance

Learn More

Spot On Coverage

Health plans we can help find coverage for:

FINANCIAL PROTECTION:

Health insurance helps protect individuals and families from the high costs associated with medical care, including hospitalizations, surgeries, and treatments for illnesses or injuries.

ACCESS TO HEALTHCARE:

Having Health Insurance provides greater access to a wide range of healthcare providers, specialists, and hospitals. This ensures that individuals can receive timely and appropriate medical attention when needed.

FOR PREVENTITIVE CARE & WELLNESS:

Many Health Insurance plans cover preventive services, such as vaccinations, screenings, and annual check-ups, at little to no cost, encouraging individuals to prioritize their health.

PRESCRIPTION MEDICATION COVERAGE:

Health Insurance often includes coverage for prescription medications, which can be essential for managing chronic conditions or recovering from acute illnesses. Access to affordable medications ensures that individuals can adhere to their treatment plans and maintain their health.

Health Plans:

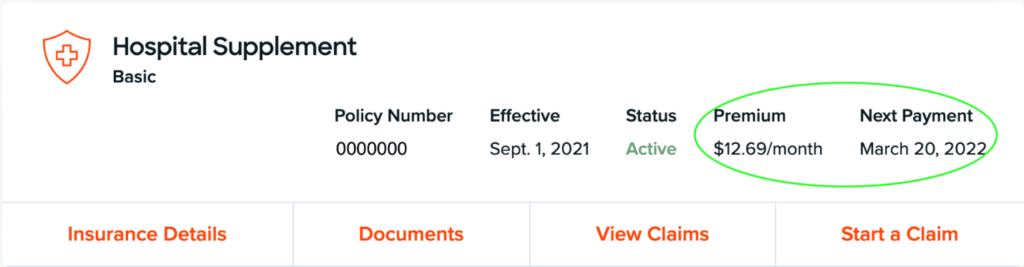

Hospital Supplemental Insurance:

This insurance provides a fixed benefit amount to help cover expenses like deductibles, coinsurance, transportation, medications, rehabilitation, or home care costs resulting from a sickness or accident during a hospital stay.

An unexpected hospitalization can impose a significant financial burden. Your health insurance may not fully cover these costs, leaving you responsible for out-of-pocket expenses. Hospital Supplemental Insurance helps alleviate this financial burden.

Benefits of Hospital Supplemental Insurance:

Financial Protection: Hospital Supplemental Insurance helps cover out-of-pocket expenses such as deductibles, co-pays, and other costs not covered by primary health insurance, reducing the financial burden on individuals and families during hospital stays.

Added Peace of Mind: Knowing that you have additional coverage specifically tailored to hospital expenses can provide individuals with peace of mind, especially in uncertain times or when facing medical emergencies.

Coverage Gaps: Even with comprehensive health insurance, there may be coverage gaps or limits on certain services or treatments. Hospital Supplemental Insurance fills these gaps, ensuring comprehensive coverage for a wider range of medical expenses.

Flexible Benefits: Hospital Supplemental Insurance plans often offer flexibility in terms of coverage options, allowing individuals to customize their plans based on their specific needs and budget. This flexibility can be appealing for those looking for additional coverage beyond what their primary insurance offers.

Affordability: Hospital Supplemental Insurance plans are often relatively affordable compared to comprehensive health insurance plans. This affordability makes them an attractive option for individuals looking to enhance their coverage without breaking the bank.

Critical Illness Supplemental Insurance:

Critical Supplemental Insurance provides coverage for a range of critical illnesses, including cancer, stroke, heart attack, major organ failure, and coronary artery bypass surgery, depending on your chosen plan. Depending on the severity of the illness and specifics of your plan, certain illnesses may receive full or partial benefits.

Facing a major health event can happen at any time, and it can be daunting, both emotionally and financially. Often, these events come with unexpected costs that may not be fully covered by your health insurance or may limit your treatment options.

This is where Critical Illness Supplemental Insurance can offer valuable support. Upon diagnosis and filing a claim, you’ll receive benefits as a cash payment. This provides you with the flexibility to seek second opinions, travel for treatment, or cover other expenses related to your illness.

Benefits of Critical Illness Supplemental Insurance:

Financial Protection Against High Medical Costs: Critical Illness Supplemental Insurance provides a lump sum payment upon diagnosis of a covered condition, covering medical expenses not covered by traditional health insurance, such as deductibles, co-pays, and experimental treatments. This financial assistance can prevent individuals and families from experiencing financial strain during a critical illness.

Income Replacement: Critical illness Supplemental Insurance can help replace lost income if the policyholder is unable to work due to their illness. The lump sum payment can be used to cover living expenses, mortgage, or rent payments, and other financial obligations while the individual focuses on their recovery.

Access to Advanced Treatments: The lump sum provided by Critical Illness Supplemental Insurance can enable individuals to access advanced or experimental treatments that may not be covered by traditional health insurance. This financial flexibility can potentially improve treatment options and outcomes for policyholders facing serious illnesses.

Peace of Mind: Knowing that they have financial protection in place in the event of a serious illness can provide individuals and their families with peace of mind. Critical Illness Supplemental Insurance offers reassurance that they will have the financial resources needed to focus on recovery without worrying about the financial implications of their illness.

Supplementing High-Deductible Health Plans: For individuals with high-deductible health plans, Critical Illness Supplemental Insurance can serve as a valuable supplement by providing financial support for out-of-pocket expenses in the event of a covered critical illness. This can help mitigate the financial burden associated with high deductibles and co-insurance requirements.

Accident Supplemental Insurance:

Accident Supplemental Insurance provides financial protection for unpredictable accidents that may result in high medical bills not fully covered by traditional health insurance. With this coverage, you’ll receive cash reimbursements for eligible medical expenses resulting from accidental injuries. A deductible may apply before benefits are paid, which can be used to pay the deductible on the major medical plan. This is guaranteed-issue insurance, available to all individuals and their families, regardless of health status, age, or other factors.

Benefits of Accident Supplemental Insurance:

Financial Protection for Unexpected Expenses: Accident Supplemental Insurance provides financial assistance to cover out-of-pocket expenses resulting from accidents, such as deductibles, co-pays, and other medical costs not covered by primary health insurance. This helps individuals and families manage unexpected financial burdens resulting from accidents.

Coverage for a Wide Range of Accidents: Accident Supplemental Insurance plans typically cover a broad range of accidents, including slips and falls, sports injuries, automobile accidents, and more. This comprehensive coverage ensures individuals are protected in various situations where accidents may occur.

Cash Benefits for Injuries: Accident Supplemental Insurance policies often provide cash benefits for covered injuries, which can be used to cover medical expenses, transportation costs, childcare, or other expenses incurred due to the accident. This financial assistance can help individuals maintain financial stability during recovery.

Supplementing High-Deductible Health Plans: For individuals with high-deductible health plans, Accident Supplemental Insurance can serve as a valuable supplement by providing financial support for out-of-pocket expenses resulting from accidents. This can help mitigate the financial impact of high deductibles and co-insurance requirements associated with primary health insurance plans.

Peace of Mind: Knowing that they have additional financial protection in place in the event of an accident can provide individuals and their families with peace of mind. Accident Supplemental Insurance offers reassurance that they will have the financial resources needed to cover unexpected medical expenses resulting from accidents.

Dental Plan:

The following may be covered up to 100% by your Dental Plan with a low-cost deductible, depending on the plan you select. Your coverage begins next day with no waiting periods on most dental insurance plans. Dental plans may include additional benefits such as LASIK, orthodontia, or hearing care. A deductible may apply for coverage.

- Exams & Cleanings

- Preventive Care

- Fillings

- Root Canals

- Orthodontia

- LASIK

- Hearing Care

Good dental hygiene not only helps you look your best, but it also prevents cavities, gum disease, and other oral health problems. Poor oral health is linked to heart disease, stroke, diabetes, and other serious health conditions. We offer an affordable and straightforward Dental Plan making it easy to take care of your teeth and stay healthy.

Benefits of a Dental Plan:

Preventive Care: Dental Plans typically cover preventive services such as regular check-ups, cleanings, and X-rays at little to no cost. Preventative care plays a crucial role in maintaining good oral health by providing early detection of dental issues and preventing more serious problems in the future.

Financial Protection for Basic and Major Dental Procedures: Dental Plans help cover the costs of basic procedures like fillings and extractions, as well as major procedures such as root canals, crowns, and bridges. Having a Dental Plan provides financial protection against unexpected dental expenses, which can be significant without insurance coverage.

Access to Network Providers: Dental Plans often have networks of dentists and specialists who have agreed to provide services at discounted rates to plan members. Accessing network providers ensures that individuals receive quality dental care at affordable prices, contributing to their overall oral health and well-being.

Treatment for Chronic Conditions: Certain Dental Plans offer coverage for treatments related to chronic dental conditions such as gum disease or temporomandibular joint (TMJ) disorders. Individuals with these conditions opt for dental plans to help manage their ongoing dental care needs effectively.

Overall Health Benefits: Numerous studies have established a strong link between oral health and overall well-being. Dental issues can contribute to systemic health conditions such as heart disease, diabetes, and respiratory infections. Individuals invest in Dental Plans to uphold optimal oral health, which in turn can contribute to better overall health outcomes and well-being.

Vision Plan:

The following may be covered up to 100% by your Vision Plan with a low-cost deductible, depending on the plan you select. Your coverage begins next day with no waiting periods on vision insurance plans. A deductible may apply for coverage:

- Exams

- Glasses Lenses

- Glasses Frames

- Elective Contacts

- Medically Necessary Contacts

- Bifocals, Trifocals, and Progressive Lenses

Benefits of a Vision Plan:

Routine Eye Care: Vision Plans often cover routine eye exams, which are essential for maintaining good eye health and detecting early signs of vision problems or eye diseases. People buy vision plans to ensure they have access to regular eye exams without incurring high out-of-pocket costs.

Prescription Eyewear: Vision Plans typically cover a portion of the cost of prescription eyeglasses or contact lenses. People buy Vision Plans to help offset the expense of purchasing corrective eyewear, making it more affordable to maintain clear vision.

Preventive Care: Regular eye exams can help prevent or detect vision problems early, such as refractive errors, glaucoma, cataracts, and macular degeneration. People buy Vision Plans to access preventive eye care services that can help preserve their vision and overall eye health.

Access to Eye Care Specialists: Vision Plans often provide access to a network of eye care specialists, including optometrists and ophthalmologists, who can diagnose and treat various eye conditions. People buy Vision Plans to access these specialists and receive specialized care when needed.

Overall Health Benefits: Like dental health, maintaining good vision is important for overall health and well-being. Vision problems can impact daily activities, productivity, and quality of life. People buy Vision Plans to ensure they can address their vision needs promptly and maintain optimal eye health.

Potential Savings to Explore:

Insurance discounts can differ depending on the insurance provider you select. It is important to note that not all carriers offer the same discounts.

Flexi-Bundle™ & Save:

Flexi-Bundle™ Discount: Combine up to four insurance products and select from up to four insurance carriers.

Frequently Asked Questions

Please Note:

At Insurish, we provide general information on insurance products to help you grasp their different aspects. It’s important to note that this information isn’t an insurance policy and doesn’t pertain to any specific carrier’s policy. It doesn’t alter any provisions, limitations, or exclusions expressly stated in an insurance policy. Descriptions of coverages, discounts, and features are concise. For a comprehensive understanding of specific policy details, we recommend reading the applicable policy and consulting an Insurish agent. Coverages and features vary by insurer and state and may not be available in all states. Coverage for accidents or losses depends on the terms and conditions of the actual insurance policy. References to premiums, losses, deductibles, and costs are illustrative and may not apply to your circumstances. Insurish is not liable for the content of third-party sites linked from this page.