Why You Need home warranty Insurance

Learn More

Spot On Coverage

Home Warranty insurance covers:

BE PROACTIVE:

With 82% of U.S. homes facing at least one repair issue annually, and nearly 50% experiencing multiple issues, preparedness is essential.

BE PREPARED, BECAUSE THINGS BREAK:

Nothing lasts forever, so it’s important to be prepared. For instance, while most HVAC systems and appliances can last 10-20 years with regular maintenance, break downs can still occur.

SKIP THE DIY STRESS:

A home warranty is ideal for those who prefer to avoid the do-it-yourself approach and rely on professionals for repairs. Opting for a home warranty helps prevent costly mistakes and potential for additional expenses if DIY attempts fail.

PROTECT YOUR FINANCES:

Investing in a warranty plan provides financial security by spreading the cost of potential home repairs into manageable monthly payments, shielding you from large, unforeseen expenses when something breaks.

There are Two Home Warranty Insurance Plans:

Standard Plan:

- $2,500 per year total coverage

- $250 deductible

- Starts at $29.99 per month.

- Maximum coverage limits by type of repair

Plus Plan:

- $15,000 per year total coverage

- Flexible deductible options ($125, $250 or $500), which affect your monthly payment. The higher your deductible, the lower your monthly payment.

- Starts at $39.99 per month.

- Maximum coverage limits by type of repair

Maximum Home Warranty Insurance Coverage Limits:

Heating & Air Conditioning:

Up to $5,000 per year

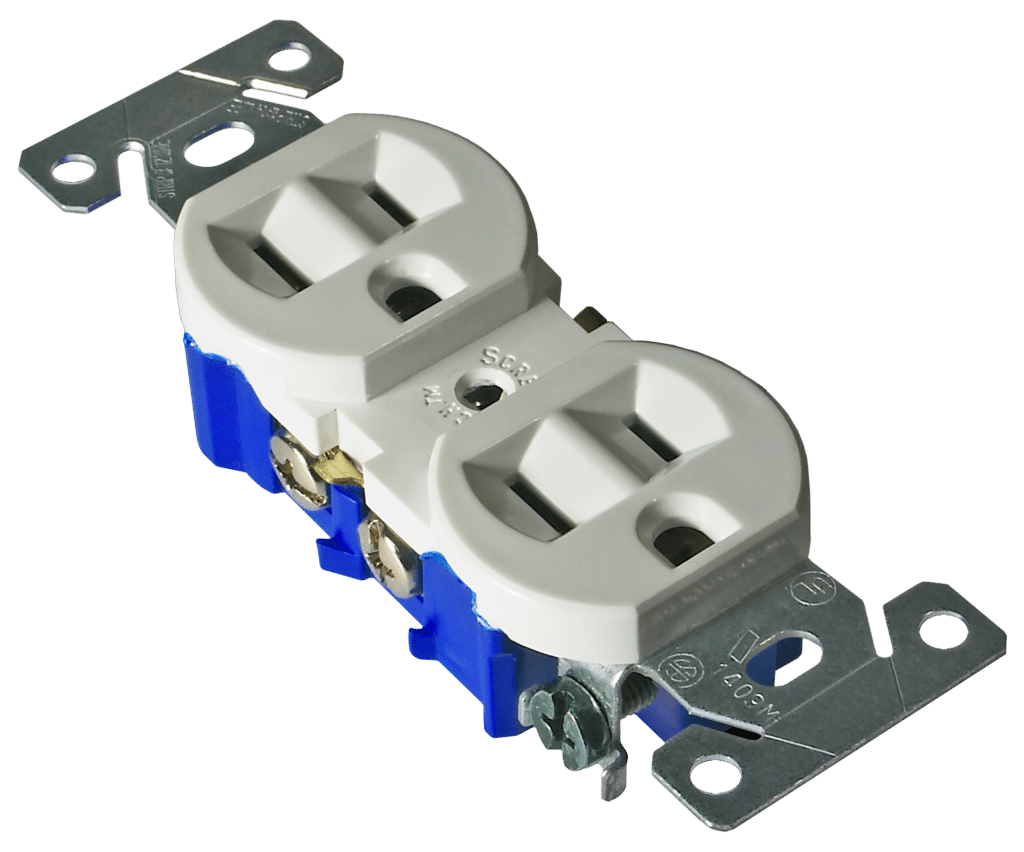

Electrical:

Up to $2,500 per year

Appliances:

Up to $5,000 per year

Plumbing:

Up to $2,500 per year

Potential Savings to Explore:

Insurance discounts can differ depending on the insurance provider you select. It is important to note that not all carriers offer the same discounts.

Flexi-Bundle™ & Save:

Flexi-Bundle™ Discount: Combine up to four insurance products and select from up to four insurance carriers.

Frequently Asked Questions

Please Note:

At Insurish, we provide general information on insurance products to help you grasp their different aspects. It’s important to note that this information isn’t an insurance policy and doesn’t pertain to any specific carrier’s policy. It doesn’t alter any provisions, limitations, or exclusions expressly stated in an insurance policy. Descriptions of coverages, discounts, and features are concise. For a comprehensive understanding of specific policy details, we recommend reading the applicable policy and consulting an Insurish agent. Coverages and features vary by insurer and state and may not be available in all states. Coverage for accidents or losses depends on the terms and conditions of the actual insurance policy. References to premiums, losses, deductibles, and costs are illustrative and may not apply to your circumstances. Insurish is not liable for the content of third-party sites linked from this page.