Why You Need mobile home Insurance

Learn More

Spot On Coverage

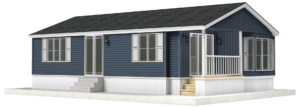

Some of the mobile homes we help find coverage for:

MORTGAGE REQUIREMENT:

If you have a mortgage on your mobile home, your lender will typically require you to have insurance coverage. Even without a mortgage, insurance provides vital protection for your mobile home, its contents, liability exposure, medical expenses for others, and loss of use situations.

LIABILITY PROTECTION:

Shield yourself from liability for injuries, property damage, and lawsuits.

MEDICAL EXPENSES FOR OTHERS:

Ensure coverage for medical expenses for others who may be injured on your property due to a covered incident.

MOBILE HOME PROTECTION:

Safeguards against repair expenses or replacement of your mobile home.

There are Five Standard Mobile Home Coverages:

Dwelling Coverage:

Protects against damage to your mobile home and any attached structures such as decks, porches, and carports.

Personal Property Coverage:

Covers your personal belongings, such as furniture, electronics, clothing, and other valuables, in case of theft, damage, or loss.

Loss of Use Coverage:

In case your mobile home becomes uninhabitable due to a covered loss, mobile home insurance may cover expenses, such as temporary accommodations and meals, while your mobile home is being repaired or rebuilt, up to your policy’s limits.

Personal Liability Coverage:

Protects you from claims or lawsuits for damages resulting from bodily injury or property damage, covering legal costs and damages up to your coverage limits.

Medical Coverage:

Provides coverage for injuries sustained by someone else on your property, regardless of fault, including medical expenses resulting from the injury.

Optional Mobile Home Insurance Coverages:

Personal Injury Coverage:

Covers legal fees and damages from slander or libel lawsuits (something you say/write that damages a person’s reputation or business); false arrest or imprisonment, wrongful eviction, and other related lawsuits against you.

Example: Your neighbor accuses you of spreading false rumors about their business, resulting in a defamation lawsuit. This coverage pays your legal fees.

Valuable Articles Coverage:

Provides protection for high-value items that may exceed the coverage limits of a mobile home insurance policy. This coverage allows you to insure items such as jewelry, art, antiques, or collectibles for their full appraised value.

Example: Your mobile home is burglarized, and valuable items, including jewelry are stolen. Thanks to your Valuable Articles coverage, you are reimbursed for their appraised value of these items.

Trip Collision Coverage:

Offers protection if your mobile home sustains damage while in transit.

Example: While your mobile home is being moved, it collides with a moving truck during transit.

Potential Savings to Explore:

Insurance discounts can differ depending on the insurance provider you select. It is important to note that not all carriers offer the same discounts.

Home Safety Discounts:

Safety Features: If your mobile home is equipped with certain safety features, such as smoke detectors, fire extinguishers, or deadbolt locks, you may be eligible for a discount.

Mobile Home Park: If your mobile home is in an approved mobile home park, you may qualify for a discount.

New Homeowner Discounts:

Age of Mobile Home: If your mobile home is new, you may be eligible for a discount.

Policyholder Savings:

Claim Free: If you have not filed a claim on your mobile home insurance policy for three years, you may be eligible for a discount.

Age of Insured: A discount may be available if you are 50 years or older.

Flexi-Bundle™ & Save:

Flexi-Bundle™ Discount: Combine up to four insurance products and select from up to four insurance carriers.

Frequently Asked Questions

Please Note:

At Insurish, we provide general information on insurance products to help you grasp their different aspects. It’s important to note that this information isn’t an insurance policy and doesn’t pertain to any specific carrier’s policy. It doesn’t alter any provisions, limitations, or exclusions expressly stated in an insurance policy. Descriptions of coverages, discounts, and features are concise. For a comprehensive understanding of specific policy details, we recommend reading the applicable policy and consulting an Insurish agent. Coverages and features vary by insurer and state and may not be available in all states. Coverage for accidents or losses depends on the terms and conditions of the actual insurance policy. References to premiums, losses, deductibles, and costs are illustrative and may not apply to your circumstances. Insurish is not liable for the content of third-party sites linked from this page.