Why You Need workers compensation Insurance

Learn More

Spot On Coverage

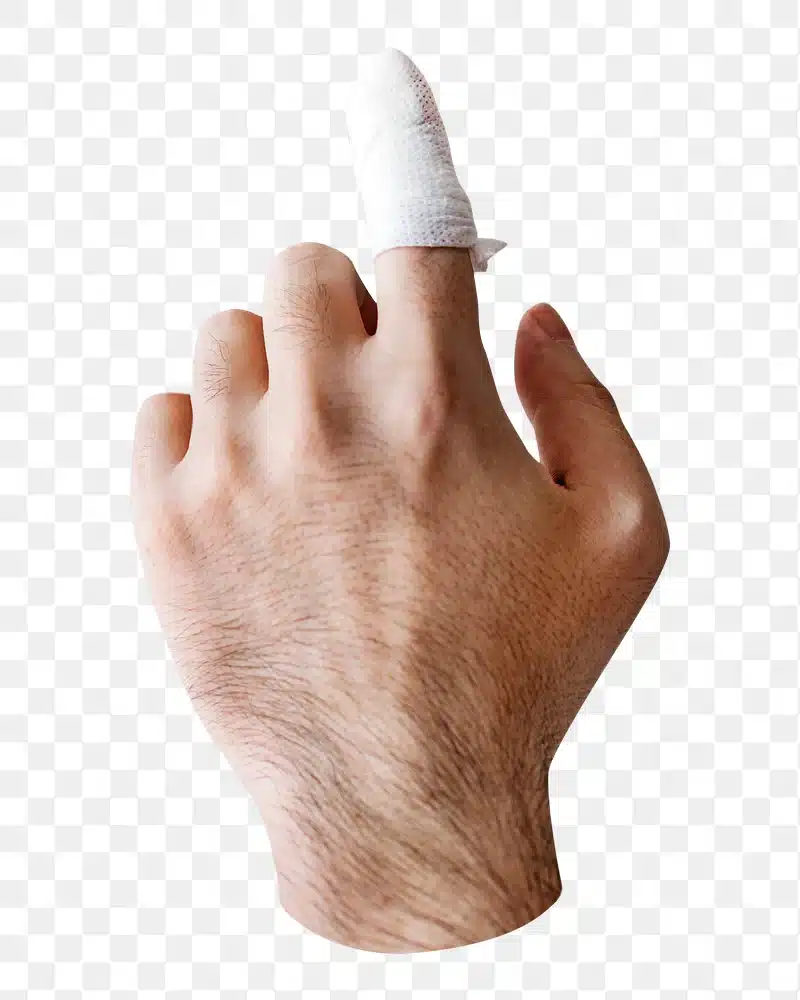

Workers Compensation Insurance covers:

REQUIRED BY LAW:

In Michigan, the Workers’ Disability Compensation Act mandates that all businesses with one or more employees are required to carry Workers’ Compensation Insurance.

FINANCIAL PROTECTION:

This coverage is essential for providing financial protection to both employers and employees by covering medical expenses, rehabilitation costs, and lost wages resulting from work-related injuries or illnesses.

EMPLOYEE WELL-BEING:

Workers’ Compensation Insurance not only ensures that employees receive prompt medical treatment and compensation for work-related injuries or illnesses, but also fosters a culture of safety and well-being in the workplace. By prioritizing employee health and safety, businesses demonstrate their commitment to their workforce, which can lead to higher morale, job satisfaction, and employee retention.

LEGAL LIABILITY:

Workers’ Compensation Insurance provides essential protection for businesses by mitigating legal risks related to workplace injuries or illnesses. By ensuring that employees are covered in the event of such incidents, businesses can avoid potential lawsuits and legal disputes. This coverage serves as a proactive measure to safeguard the business’s financial stability and reputation by demonstrating a commitment to employee welfare and compliance with legal obligations.

Frequently Asked Questions

Please Note:

At Insurish, we provide general information on insurance products to help you grasp their different aspects. It’s important to note that this information isn’t an insurance policy and doesn’t pertain to any specific carrier’s policy. It doesn’t alter any provisions, limitations, or exclusions expressly stated in an insurance policy. Descriptions of coverages, discounts, and features are concise. For a comprehensive understanding of specific policy details, we recommend reading the applicable policy and consulting an Insurish agent. Coverages and features vary by insurer and state and may not be available in all states. Coverage for accidents or losses depends on the terms and conditions of the actual insurance policy. References to premiums, losses, deductibles, and costs are illustrative and may not apply to your circumstances. Insurish is not liable for the content of third-party sites linked from this page.